“What do you want to achieve or avoid? The answers to this question are objectives. How will you go about achieving your desire results? The answer to this you can call strategy.” ― William E. Rothschild

Over the past few years, there’s been significant focus on the profession of financial planning. Regulators, associations, product providers, consumer advocates and the media have all pontificated on their ideal “financial planning professional”.

Not that there’s anything wrong with such conversations; all professions need to continually challenge themselves to improve. However, in my opinion, the real return on investment (i.e. significant benefit for the clients of financial advisers) for all this effort will be small and perhaps even negative.

My reason for this assertion is that while the professional intelligence of financial advisers (product knowledge, tax, strategy, etc) is important. Our business intelligence provides significantly more benefit to our own business and, ultimately, our clients. And unfortunately, there’s been very little focus in this area.

What is business intelligence?

The term Business Intelligence is usually used to refer to the collection and presentation of business data.

For this discussion, however, I’m referring to the ability to identify and move toward a set of clear objectives, by applying experience and skill in the combined areas of financial, human, project and risk management.

Unfortunately, many professionals (not just financial planners) go through their entire career without spending time/resources on developing their business intelligence. Business intelligence is not something that can be regulated or taught. It must be sought and acquired through hands on experience & guidance from others with experience.

How does it help?

“What’s the use of running if you are not on the right road.” ― German proverb

Business intelligence enables you to develop a clear and complete view of the big picture.

Applied to your own business, it helps you dissect your existing strategy, choose key business metrics, identify risks in advance and develop ideas for improvement.

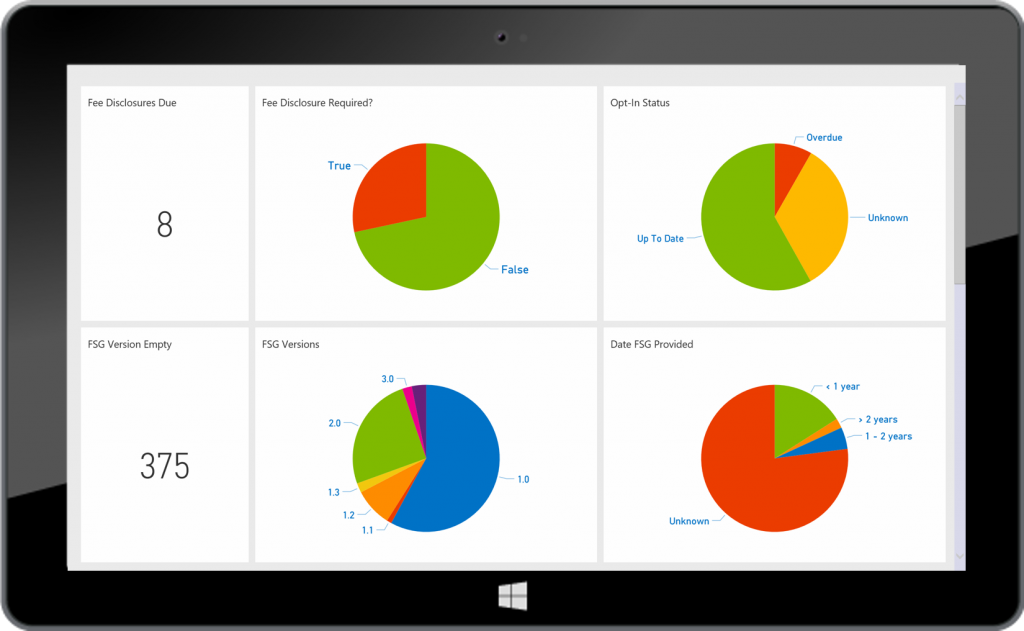

In our own business for example, after going through our planning process, we identified the following as key metrics that would allow us to monitor business health.

- The distribution and performance of lead/referral sources

- The efficiency with which new clients are moved through the advice process

- Average revenue per converted opportunity

- Ongoing revenue received vs time spent on clients

- % of team activity recorded in our CRM system

As well as improving the manageability & profitability of your own business, a secondary benefit gained by developing your business intelligence will be the added value you can provided your clients.

The art of business intelligence can be applied to any profession and also to our personal financial situation. Utilising the same process with your clients will help you analyse and articulate their situation in a way that will not only be refreshing (compared to traditional financial planning methods) but also provide instant value through clarity.

Making it easy

“However beautiful the strategy, you should occasionally look at the results.” ― Winston Churchill

A primary reason business intelligence has, historically, not been given the attention it deserves is because of the time required to generate the data required to complete the process.

Identifying key business metrics is pointless if they are not being measured. And spending hours dissecting thousands of lines of data on a spreadsheet is hard to justify in the face of all your immediate priorities.

Thankfully, modern CRM and Business Intelligence software makes it easy to track the data and automatically generate the reports required both in your own business and for your clients.

About FinPal

FinPal’s financial planning software offers an end to end client and business management solution. Hosted on Microsoft’s enterprise grade Dynamics 365, Azure and Power BI it provides business intelligence tools previously unavailable to financial advisers. It’s seamless integration with Outlook and Sharepoint enhance business efficiency even further.