One of the biggest impacts the many mandated reforms are having on financial planning businesses is a need to review the way they manage the ongoing service and support of clients. Historically, businesses were able to rely on passive income trail which provided a quasi-socialist service model. Ongoing service was provided equally to all clients, as needed and without regard to hours spent. Percentage based remuneration meant clients with higher account balances paid higher fees, effectively cross subsidizing the work done for lower paying clients.

Over the past few years, as businesses have transitioned to fee for service, many with flat dollar based ongoing service charges, it has quickly become necessary to ensure time spent on clients is commensurate with revenue received.

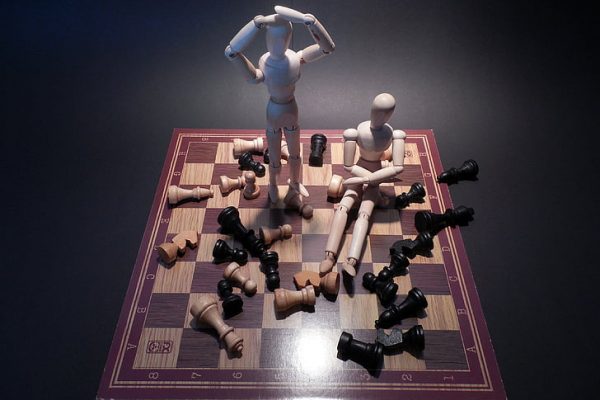

The Goldilocks test

By monitoring time spent on ongoing service activities, financial planning businesses’ can quickly identify higher paying clients who are not receiving adequate attention or lower paying clients requiring too much attention. Business and/or fee adjustments can then be made to ensure both customer expectations and business profitability are kept at desired levels.

Automated business intelligence reports

FinPal’s financial planning software automatically links activities such as meetings, phone calls, tasks and emails to contacts. Time spent on clients can then be monitored against revenue received using our revolutionary business intelligence system.