In this recent blog post, William Borden, Microsoft CVP of Financial Services Industry, introduces the concept of Tech Intensity and it’s impact on business success. In the post, Borden defines the equation as:

Tech Intensity = (Tech Adoption X Tech Capability) ^ Trust

While this blog post from William Borden at Microsoft is focused on the bigger end of town, the components of his formula are just as relevant for smaller organisations where the relationship with the end customer is even deeper.

Based on the conversations I’m having with financial advisers, brokers and accountants, it’s fair to say developing an effective technology strategy tops the list of short term priorities for most financial services businesses.

Given I’ve not been clever enough to formulate my own equation, I thought it would be an fun exercise to attempt to align my own recommended approach to Borden’s formula.

Tech Capability

Data foundation (CRM)

Your data needs to be complete, clean and consolidated if you’re to derive any value out of your technology stack. Just as cash flow security should form the foundation of any quality financial plan, data quality is the foundation of your technology strategy.

Connectivity/integration (APIs)

Your data needs to flow between the various applications and systems you interact with in your business. Wherever possible you need to eliminate “swivel chair syndrome”. I.e. the constant duplication of effort/entry we’ve be accustomed to in our industry.

Application capability

With the (above) foundation in place, the quality of the applications you leverage becomes a cost benefit decision. Does this application perform a unique function that delivers more value to my business than it costs?

Tech Adoption

But even if you get all of the above right, you can still fail. Which is why the Tech Adoption part of Borden’s formula, or what I refer to as “business embedding”, is so important. Without a consistent and disciplined approach by all members of your team, the value you will derive from (even the best) technology will be limited.

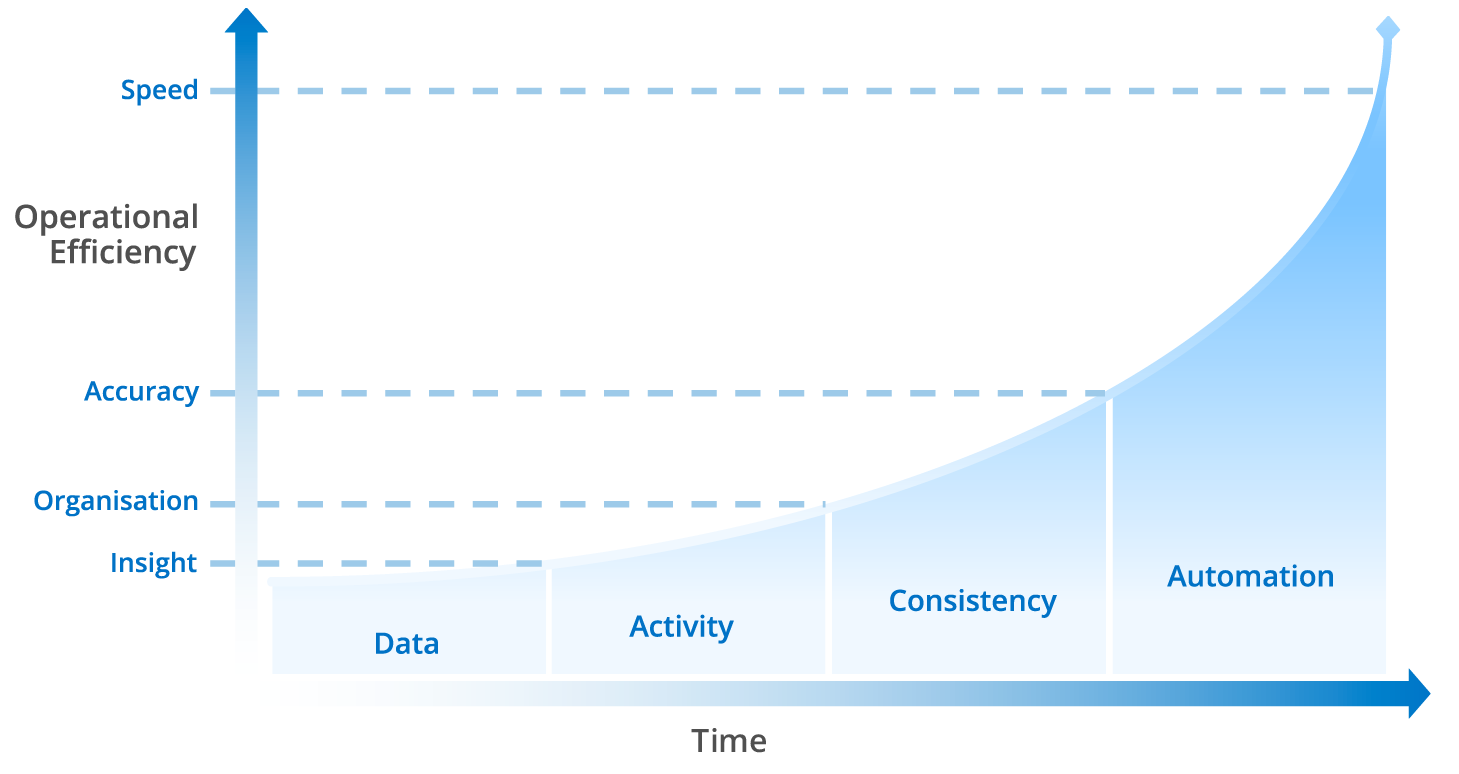

Without exception, what I’ve discovered is that all businesses who undertake technology changes also embark on a data journey. Because of the historically “messy” and distributed nature of data in our industry, this journey is rarely quick or easy. Inevitably there is some resistance because it requires a change in behavior. But only those who successfully navigate this journey will see ultimate business success.

Data Automation Journey

…

…

Trust

Even more so than the large institutions, which historically have been more focused on product than service, client facing professions such as advisers and accountants, have always relied heavily on the currency of trust. As these businesses look to modern technology to improve their customers’ experience and their own operational efficiency, it will be important to ensure that the privacy/confidentiality their customers rightly expect is not compromised due to poor security/compliance practices. While financial services businesses will rely on their technology providers to deliver systems that offer first class security capabilities. Business policies and procedures will also play a critical role in this area.

Tech Intensity = Business Success

There is no doubt in my mind that Borden’s “Tech Intensity” formula, correctly executed, will result in better customer outcomes and a more profitable business.

About Fin365

Fin365’s innovative software solutions enable financial services businesses to deliver better outcomes to more clients, more efficiently.

Leveraging the power of Microsoft 365 enterprise technologies, we’ve added the necessary ingredients and integrations to turn these powerful tools into instantly useful solutions that deliver tangible benefits for your business.

You can test drive Fin365 here or contact us for a complimentary demo