By Stephen Handley, FinPal CEO

“Here we all are, with nothing but our wit and our will to save the world!” – Nick Fury

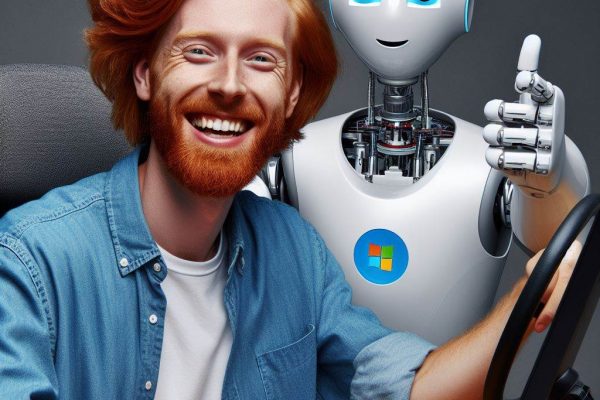

Robo-Advice is definitely one of the hot topics in financial services. While few would disagree Robo-Advice will disrupt the traditional financial planning model, many commentators are taking delight in more extreme predictions, such as “automated investment advice is set to become the core of financial planning services” and “artificial intelligence is set to take over a variety of jobs within 20 years, including financial advice”.

It may be the experience I’ve gained over 20 years working in both the technology and financial services industries, or it could just be because I’m an avid Avengers fan, but I’m going to go out on a limb and make a bold prediction; the Robo-Adviser will be no match for the Enhanced Adviser.

During my years in the tech industry, I witnessed a tendency to be wowed by new technologies and the possibilities they bring. I also witnessed (many times) the eventual realisation that technical innovation can only truly succeed by taking into account human nature.

The limitation of the Robo-Adviser

“I was designed to save the world. People would look to the sky and see… hope.” – Ultron

Proponents of Robo-Advice believe “FinTech” will solve the issue of people being disengaged with their finances, drawing the incorrect conclusion that complexity, cost and/or lack of trust in the current system is the primary cause.

Unfortunately, although they correctly identify the problem, their assumption that Robo-Advice is the solution is fundamentally flawed.

While it may deliver a simplistic/cheap form of financial advice, Robo-Advice does not remove emotion, it does not instil discipline, and it most certainly does not eliminate the potential for “corporate scandals.”

More importantly, it fails to take into account human nature. “The world of robotics has yet to master three critical attributes; empathy, trust and fine judgment.” – discus.org.uk

The dawn of the Enhanced Adviser

“We’re fighting an army of robots, and I have a bow and arrow.” – Hawkeye

I’ll be the first to acknowledge that financial advice should be less complex and less costly. Not a day goes by where inefficiencies in the financial services industry don’t cease to amaze me.

That said, the recent emergence of well architected, integration friendly, financial planning software components will soon deliver technological tools that will enhance human advisers ability to compete with robo-advisers.

By taking advantage of these new software solutions, financial planners will benefit from a fully integrated suite of technologies that provide:

- Integrated CRM, Email and Document Storage

- Real-time Business Intelligence

- A real time view of their clients’ current financial situation

- Efficient advice/document generation

- Low cost, feature rich financial products

Combined with the empathy, trust, and other intangibles required to understand the human element of financial advice, these technological advancements will equip financial advisers to deliver an outcome far superior to any artificial intelligence, no matter how “cool” it looks/sounds/feels.

About FinPal

FinPal’s financial planning software solution is enabling modern financial advice businesses to realise a new potential. Our fully integrated business management and intelligence software enhances team performance, increases client engagement and reduces business risk, resulting in a more profitable business. Click here to learn more.