A chance is what you take before you think about it. A calculated risk is what you take after you have evaluated all possible factors and have determined that risk – Craig Elliot

I recently came across a report by Scalable Capital, which asserted that risk labels had become meaningless and may mislead the ordinary investor, citing results of a study in which 70% of investors significantly underestimated the amount by which investment portfolios could potentially fall in a bad year. The same study found that 76% of respondents manage their own investments.

While reading this, I found myself having flashbacks to my early days as a financial planner, dutifully asking my clients risk profiling questions from our dealer group’s fact find document, such as:

- Which of the following best describes your attitude to volatility of returns?

- How concerned are you that the value of your capital and the purchasing power of your investment income should keep pace with inflation?

- Are you prepared to invest in tax-advantaged investments that may fluctuate in value, in order to minimise your income tax?

OK! OK! I lied! I never read the above questions to a client. Would you? The fact such questions were ever deemed an appropriate way to discuss risk really does boggle the mind.

Regardless of how accurately they claim to measure a client’s psychological appetite for risk, traditional Risk Profiling techniques are fundamentally flawed because they fail to:

- Segment a client’s portfolio based on time/need to access

- Factor in the client’s desired outcomes

- Demonstrate the trade-off between short-term risk and financial outcomes

Thankfully, Investfit, has redefined the way clients should consider risk.

According to Founder James Claridge, “If an adviser wants to find an investment strategy that best achieves the client’s goals within their risk tolerance, they need to know the risk of a client failing to meet their goals as well as the client’s tolerance for variability in short-term returns”

Investfit has developed a tool that helps advisers present information in a way their clients are able to understand how much retirement income they give up in exchange for more stable short-term investment returns.

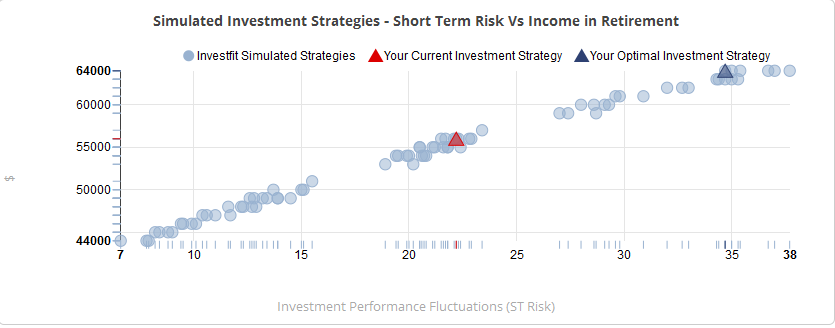

Consider the example below. Each dot on this scatter plot corresponds to an investment strategy. The vertical axis shows the retirement income that the investment strategy would produce and the horizontal axis shows some measure of “short-term risk” – in this case the worst annual investment return they might expect from the investment strategy (a value of 20 means a “worst case” annual return of -20%). Importantly, the retirement income shown for each investment strategy has 90% certainty* i.e. there is only a 10% risk of falling short of this retirement income.

So the question for the client becomes “you could have $64,000 per year in retirement with 90% certainty* (top right of the chart), but you will likely experience some large negative investment returns on the way (eg a loss of 35% in one year), or you can have only $44,000 per year in retirement with the same 90% certainty* (bottom left of the chart) but experience a smoother ride, which would you prefer?”

This shift in focus, results in a more collaborative approach to advice, significantly enhancing the adviser/client relationship and empowering clients to make more informed decisions.

About FinPal

Like Investfit, FinPal’s financial planning software equips advisers with the tools they need to improve the way they engage clients. Our data driven, ecosystem friendly philosophy delivers increased efficiency, enhanced intelligence and ultimately more value for clients at reduced costs.