Client Management

Sitting at the heart of Fin365’s software is a sophisticated Client Relationship Management (CRM) system. A strong CRM foundation is essential to any quality service management software.

Rather than reinvent the wheel Fin365 chose Microsoft Dynamics, an enterprise grade, cloud based CRM, which is used by more than 1.4 million people worldwide. By leveraging the power of Dynamics, Fin365 can deliver reliability, scalability, flexibility and performance unmatched by other financial planning software.

Instantly Useful & Endlessly Flexible

Most CRM systems, even those purpose built for Financial Advisers, require significant customisation before they provide any real value. Fin365 is instantly useful out of the box, while still allowing any customisations needed to meet your unique needs.

Instantly Useful & Endlessly Flexible

Most CRM systems, even those purpose built for Financial Advisers, require significant customisation before they provide any real value. Fin365 is instantly useful out of the box, while still allowing any customisations needed to meet your unique needs.

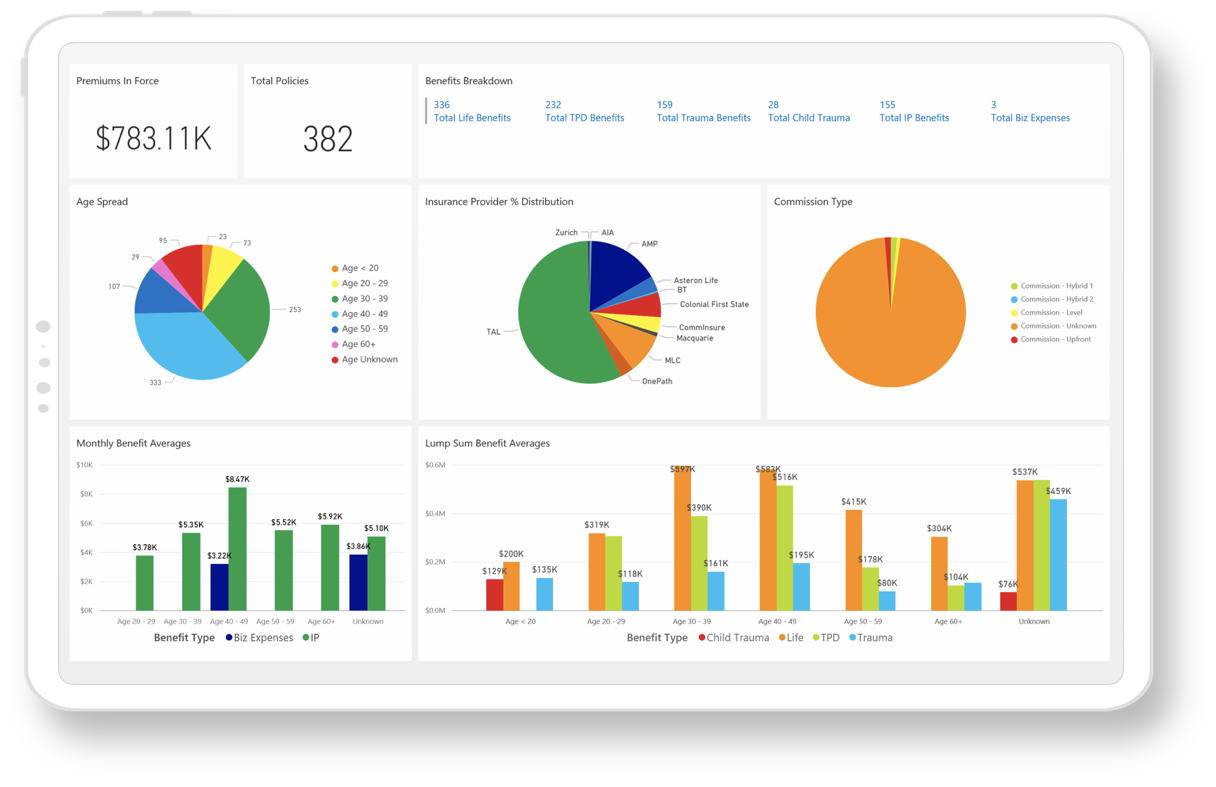

Business Intelligence

Fin365’s Business Intelligence (BI) system takes advantage of the tight integration between Microsoft’s Dynamics CRM and Power BI software products.

Dozens of insightful reports are automatically updated daily, giving you a real time view of business performance indicators. Custom reports can quickly and easily be added to meet the unique needs of your business.

Web Portal

Fin365’s Web Portal, provides a collection of additional web services and exposes the most common CRM data in an easy to read, user friendly format, delivering an enhanced client experience and further business efficiencies.

Client Reporting

Clients are given clear, up to date, view of both their existing situation and their future outlook, if they maintain the status quo. Armed with this valuable information, conversations around change will become significantly easier and more productive.

Fact Find

Clients and staff can quickly and easily submit key fact find information directly through the portal, increasing response rates and reducing the time staff spend on manual data entry.

Fee Disclosure/Opt-In

Annual fee disclosures are delivered on time and automatically through the portal, prompting clients to opt-in when required. Compliance dates are tracked in CRM and automatically updated upon client acceptance.

Administration Tools

Other valuable tools such as revenue importing, product feed administration and document generation are all accessible through the web portal interface.

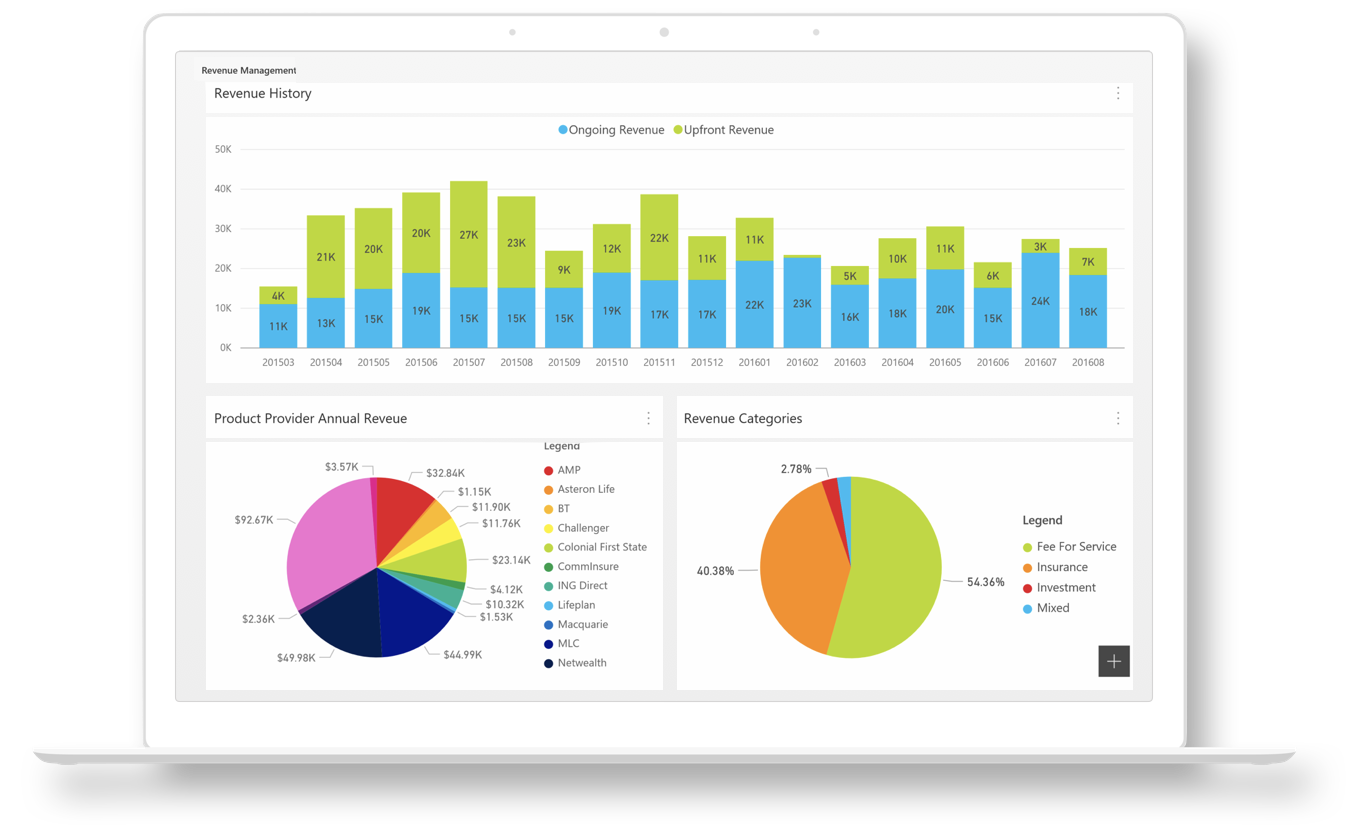

Revenue Management

Most Financial Planning firms receive thousands of revenue transactions per year. Manually tracking all these transactions is not an option, leaving many businesses in the dark about their most important business metric.

Fin365’s revenue management system automatically links revenue transactions to advisers, clients, products, referral partners & product providers, which in turn enables the powerful reporting in our Fintel BI system.

Ongoing revenue is measure at both the individual client and household levels. Combined with our Activities tracking, the automated fee disclosure reports make it easy to demonstrate the value you’re providing your clients and also identify those clients who are not profitable.

New business revenue is monitored for accuracy and automated alerts sent when revenue is missing. The comparison of new business revenue to the amount of work done provides invaluable feedback on your fee structure.

Workflow Management

Effective workflow, or project management is a critical but often misunderstood discipline, especially in businesses who don’t have the luxury of dedicated resources.

At any given time, financial advice firms have multiple varying projects, including new business opportunities, client reviews, product provider administration, insurance claims, etc. Quality workflow management ensures work is prioritised correctly, task sharing is done efficiently and quality standards are maintained. The result is a finely tuned business that consistently exceeds client expectations for timely delivery of quality advice.

Fin365’s financial planning software, includes a variety of Workflow Management features, including:

> New business process management

> Insurance claims management

> Compliance/quality control gates

> Activity Sharing through queues

> Activity sync to Outlook

> Activity reporting through Power BI

Fin365’s financial planning software, includes a variety of Workflow Management features, including:

> New business process management

> Insurance claims management

> Compliance/quality control gates

> Activity Sharing through queues

> Activity sync to Outlook

> Activity reporting through Power BI

Document Generation

Historically document generation has been one of the most tedious activities for a financial planning business. And while other financial planning software have document template features, they are restrictive, complex and generally produce very ugly documents.

To help businesses reduce the amount of time spent on manual creation of documents, Fin365 offers a range of different document generation options.

Dynamics CRM has multiple report & document generation options, including quick and easy set-up of templates directly in Word, allowing easy customisations of fonts, colours, logo placement, etc.

Fin365’s Web Portal also includes a web based document generation facility that will make it easy to produce more sophisticated document such as Client Reports and Advice Documents.

Third Party Integrations